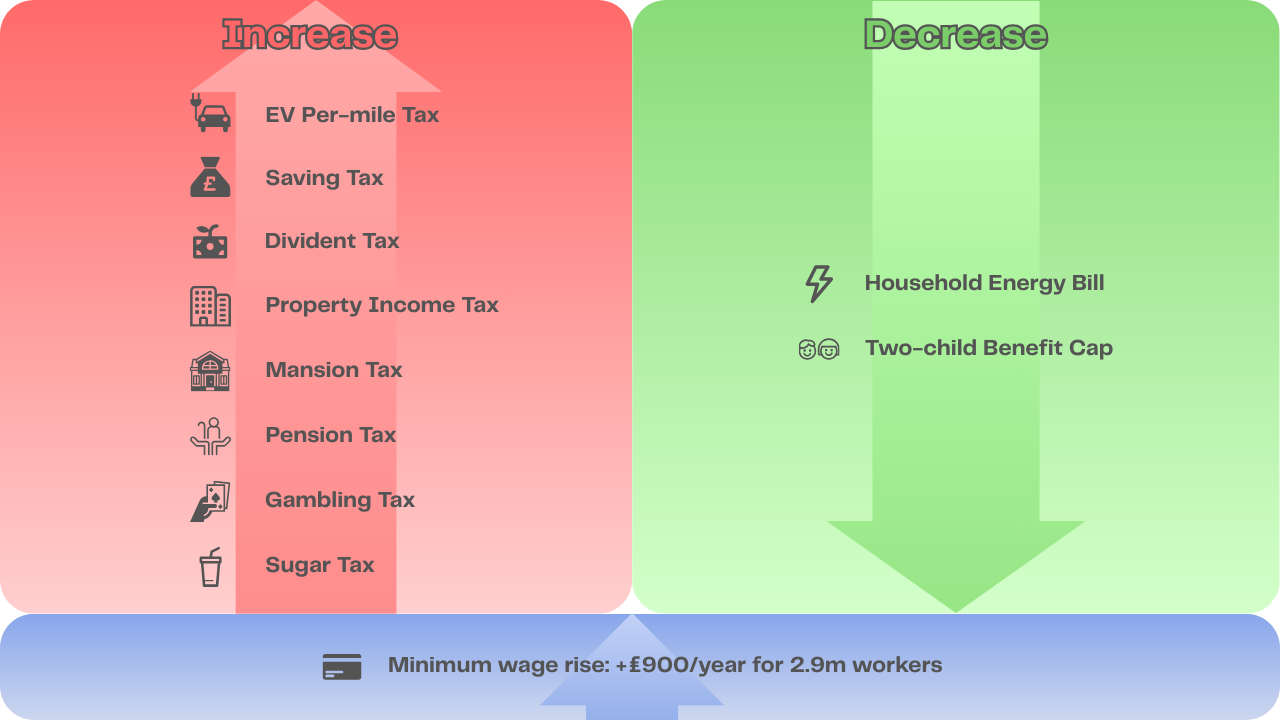

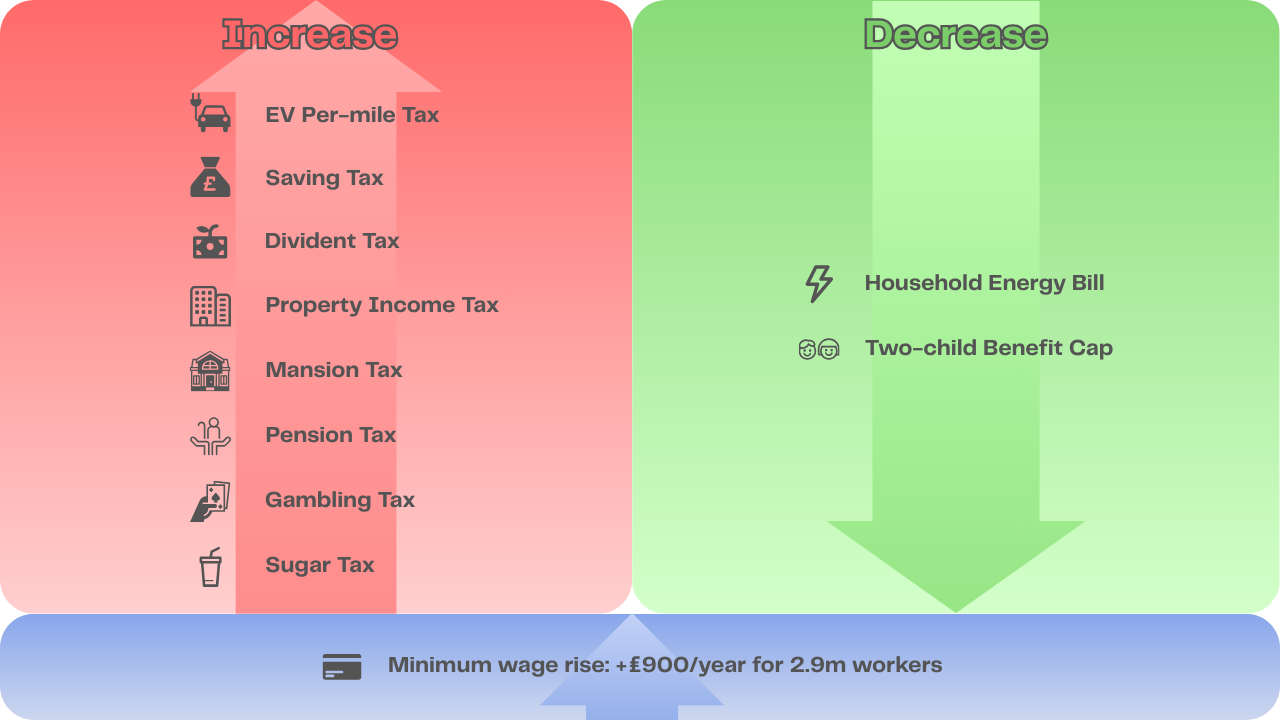

The 2025 Budget introduces a set of tax and policy changes that will shape household finances in the coming years. Several costs are set to rise, particularly around savings, property and consumption, while the main areas of relief come through lower energy bills and renewed support for larger families.

Here is a simple breakdown of what changes for households.

What gets costlier?

Electric vehicles

A new per-mile tax will apply to EVs, replacing the fuel duty that electric car drivers currently avoid. This means running costs for EV owners will increase.

Savings and dividends

People who earn interest from savings or receive dividends will pay more tax. This will mainly affect those with significant savings or investment portfolios.

Property income and high-value homes

Landlords and people earning rent from second homes will face higher tax on property income. A new annual charge will also apply to homes worth more than £2 million, with an even higher band for homes above £5 million, adding pressure to households with high-value assets.

Pension contributions

Changes to salary-sacrifice rules will limit how much can be paid into pensions tax-free each month. Anyone contributing more than £2,000 will see part of it taxed, raising the cost of saving at higher levels.

Sugar and gambling duties

Taxes on sugary drinks and gambling are rising. This could mean slightly higher prices for high-sugar soft drinks and increased costs for regular gamblers.

What gets cheaper or easier?

Energy bills

Average household energy bills are set to fall by around £150. This is the main direct financial relief in the Budget and will offset some of the increased costs elsewhere.

Support for larger families

The two-child benefit cap will be scrapped from April 2026. Families with more than two children will receive support for every child again, lifting incomes for many low- and middle-income households.

Income boost: Minimum wage rise

Alongside the tax changes, pay for low-income workers will increase. Around 2.9 million people will see their earnings rise by about £900 a year on average due to the higher minimum wage. This provides an income boost at a time when several other measures in the Budget are set to place additional pressure on household finances.

What this means for most households

For many people, the Budget brings a combination of higher taxes on savings, pensions and consumption, balanced against modest help with energy costs and significant support for larger families. Households’ experiences will vary depending on their income, assets, and family size.

How commentators and the Chancellor responded

Reactions to the Budget have been mixed. During the FT’s Ask the Experts session, columnist Stephen Bush said the plan may not land well with voters, arguing that the government has “ended up with the worst of all options,” citing tax rises that could slow growth, limited funding for public services, and no clear plan for improvement.

Chancellor Rachel Reeves defended the strategy, saying the goal is to stabilise the public finances after a difficult period. She acknowledged that “working people will pay a bit more,” but argued that the Budget aims to bring in steady revenue now to avoid more abrupt tax increases later.