Milkshakes, coffee drinks and non-dairy milk substitutes will no longer be exempt from the sugar tax, starting on 1 January, 2028.

The tax, officially known as the soft drinks industry levy (SDIL), was announced ahead of Wednesday’s much-anticipated budget by Health Secretary Wes Streeting. His department estimates that it would cut “17 million calories a day” and “prevent cancer, heart disease and stroke”.

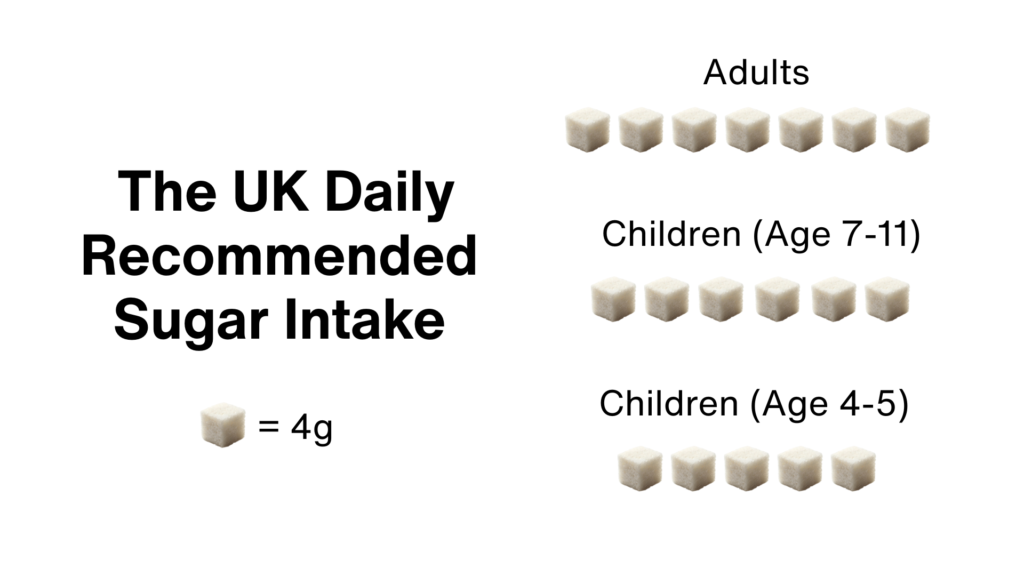

Under previous guidelines, milk-based drinks were exempt from the sugar tax because they contained calcium alongside naturally-occurring sugars. However, the government fears that this ‘loophole’ has been exploited by manufacturers who use it to load their drinks with sugar.

The levy was cheered by medical doctors, health NGOs and youth activists. Executive Director of policy at Cancer Research UK, Dr Ian Walker, welcomed it as a step forward for the nation’s health.

“These steps will help cut sugar consumption, support healthier choices, and ultimately reduce the risk of cancer,” he said.

Children’s Food Campaign manager Barbara Crowther likewise supported the initiative for choosing children over “corporate profit”.

“Companies who’ve already reduced sugar will now be rewarded for acting responsibly, whilst those still stacking excess sugar into milkshakes will now have a clear choice,” she said in a press release.

However, industry experts are less than pleased. Consumer consultant at Argon & Co James Watson, claims the levy will erode the beverage industry’s competitiveness.

“Every reformulation requires manufacturers to reassess additives, labelling and certification. These small domestic policy shifts quietly erode the UK’s competitiveness overseas,” he told Food Manufacture magazine.

Makers of oat milks and other plant-based milk alternatives were also “incredibly disappointed” by the decision, according to a press release from industry group Plant-based Food Alliance (PBFA).

Since the levy does not tax naturally occurring lactose in milk, it creates an uneven playing field in favour of dairy products. It also “discriminates” against those who cannot consume dairy.

“Favouring sweetened milk-based products over sweetened plant-based products is a missed opportunity to deliver fairness,” the PBFA said.

Explore the visuals below to see how the sugar tax will impact your sweet tooth.

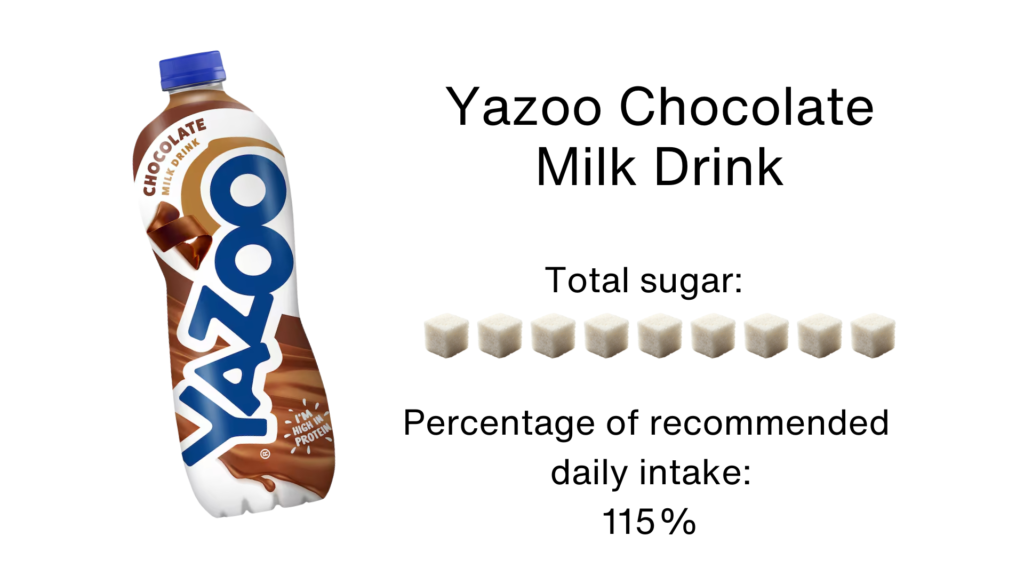

A milkshake tax on supermarket shelves

Bottled drinks and packaged milk drinks found in the supermarket aisle will be taxed at the following rates:

19p per litre on drinks with more than 4.5g of sugar per 100ml.

26p per litre on drinks with more than 8g of sugar per 100ml.

Tougher rules for fizzy drinks

Many of the UK’s most popular sodas will also be affected. Currently, the lowest tax rate applies for drinks with more than 5g of sugar per 100ml.

Under the new rules, drinks must have less than 4.5g of sugar per 100ml to avoid the tax.

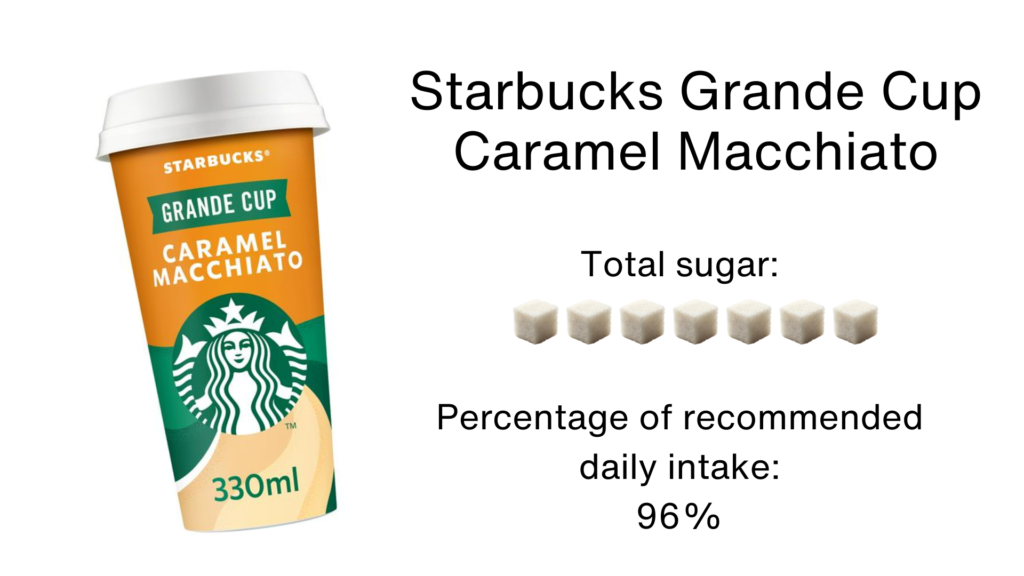

Cafes and bars escape higher costs

Cafes, bars and restaurants may breathe a sigh of relief. All drinks including juices, milkshakes and coffee-based beverages made in cafes or restaurants continue to be exempt from the sugar tax, despite being some of the sweetest available to consumers.

Sugar taxes are growing in popularity

The UK is neither the first to introduce a sugar levy, nor the country with harshest tax. The honour for being the first belongs to Norway, which started its sugar levy in 1922. It also charges the highest amount at £0.43 per litre.

Many countries, such as Germany and the Netherlands, are considering a similar policy to improve public health.

However, policymakers ought to be careful. Norway’s sugar tax is so high that Norwegians with a sweet tooth often drive across the border to Sweden for a sugar fix.