(Picture Credits: Philip Veater on Unsplash)

Latest findings by Vista Technology Support identified a 72 per cent rise in cash use as a repercussion of the cost-of-living crisis and high inflation in the UK.

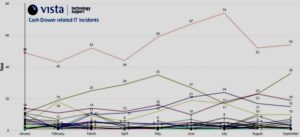

The retail and hospitality technology services provider spotted the significant increase in cash drawer related IT incidents raised by retailers in the last few months.

This followed the release of Post Office reports which noted the handling of a record-breaking amount of cash (£3.45 billion) in the month of August.

Cash use had been on a steady decline, even before the pandemic when a mega-shift to card payments was observed. However, with high inflation and economic uncertainty in picture, people seem to be returning to the safety of notes.

The Executive Vice-Chair of MasterCard Ann Cairns recently tweeted about how far along the UK is in going cashless.

The UK is ‘far from being a #Cashless society.’ Although #DigitalWallet use is increasing, only 5% of the population is living completely cash-free as of today. Both a regional and generational divide is contributing to a lack of movement in this area. https://t.co/cQhnp9ak4J

— Ann Cairns #NHSblueheart 💙 (@AnnMCairns) December 1, 2022

A full-time worker, waitressing in the “expensive” city of London said: “When the cost-of-living crisis started biting me, I decided to take jobs that paid my salary in cash so that I could avoid paying tax.”

A basic rate of 20 per cent is charged in the country when the income earned is between £12,571 and £50,270. A higher rate of 40 per cent is levied on a taxable income of £50,271 to £150,000, whereas an additional rate of 45 per cent goes on an income over £150,000.

Vista Technology Support first detected the increase in IT incidents relating to cash drawers in July 2022. According to this service which manages tens of thousands of IT incidents every month, the figure has remained consistently high ever since.

Another reason behind this could be the reinstating of cash drawers that had been decommissioned during the pandemic. This was a time when people turned to contactless payments to contain the spread of coronavirus by minimising contact through cash.

As things are slowly getting back to normal, people have started using cash again, bringing legal tender back in circulation. According to the interim findings of a recent study ‘Access to Cash’, over eight million adults in the UK still rely on cash to make payments every day.

Around 1.7 million people in the country do not have a bank account either. Out of this, 90 per cent are on low incomes and have low overall household income.

A part-time worker stationed at the till in one of the branches of JD Wetherspoon noted: “While card payments were at a high just after the pandemic, I have been seeing more cash payments recently. Most of them are from the elderly who struggle with the digital modes of payment.”

While cash is forecasted to account for just 6% of payments within a decade, a cashless society seems to be dubious considering the status quo of the economy.